Smart Choices, Bright Futures: Why and How You Need To Save for College

Smart Choices, Bright Futures: Why and How You Need To Save for College

Blog Article

Optimizing Your University Savings: Secret Financial Planning Techniques

As the expense of university continues to increase, it comes to be progressively vital to develop reliable financial planning methods to optimize your college cost savings. In this conversation, we will certainly discover key economic planning techniques that can help you navigate the intricacies of university savings and ensure you are well-prepared for the journey in advance.

Beginning Saving Early

To maximize the potential development of your university savings, it is important to start conserving early in your financial planning journey. Starting early enables you to make the most of the power of compounding, which can substantially raise your savings in time. By starting early, you provide your money even more time to benefit and grow from the returns generated by your investments.

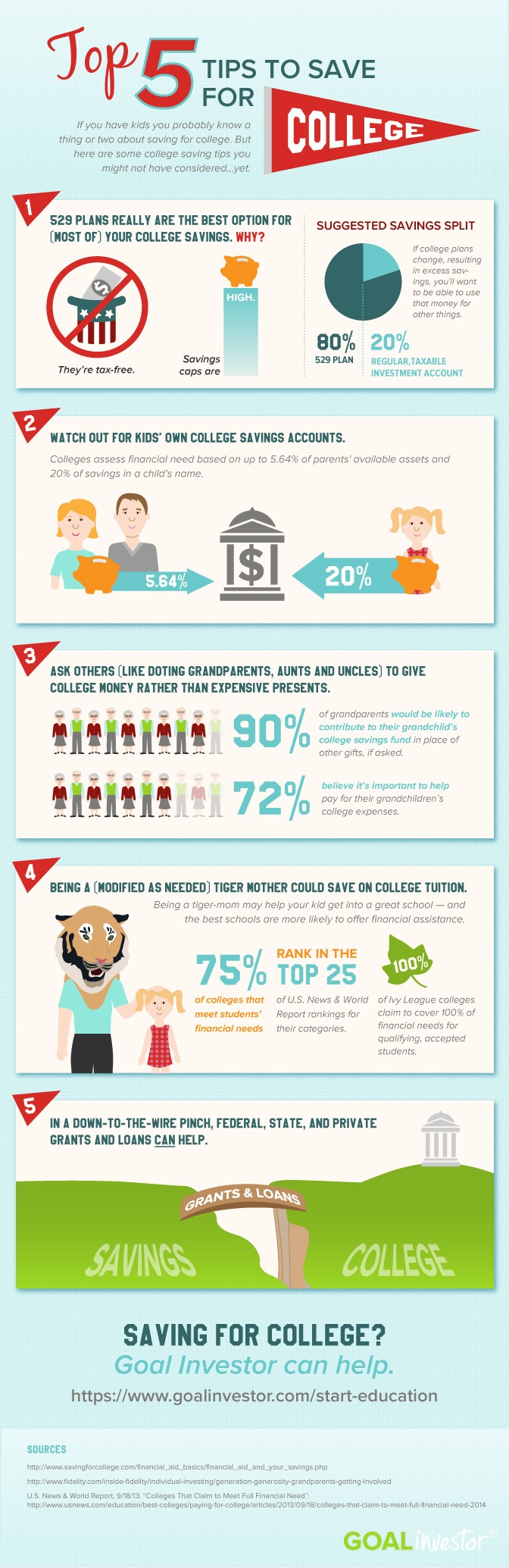

When you begin saving for college early, you can also make the most of numerous tax-advantaged savings vehicles, such as 529 plans or Coverdell Education Savings Accounts. These accounts offer tax benefits that can aid you conserve better for college expenses. Additionally, beginning very early offers you the chance to contribute smaller quantities over a longer duration, making it a lot more workable and less burdensome on your spending plan.

An additional advantage of starting early is that it permits you to set sensible cost savings goals. By having a longer time perspective, you can much better prepare and adjust your financial savings approach to satisfy your college funding needs. This can aid ease tension and give tranquility of mind knowing that you get on track to accomplish your savings objectives.

Discover Tax-Advantaged Cost Savings Options

529 plans are popular tax-advantaged financial savings choices that offer a series of financial investment alternatives and tax obligation advantages. Payments to a 529 plan expand tax-free, and withdrawals for qualified education and learning costs are also tax-free. Coverdell ESAs, on the other hand, allow contributions of approximately $2,000 per year per recipient and deal tax-free growth and withdrawals for qualified education expenditures.

Establish Sensible Conserving Goals

Developing realistic conserving objectives is a necessary action in effective monetary preparation for college costs. When it comes to saving for university, it is necessary to have a clear understanding of the costs entailed and set attainable objectives. By setting sensible conserving objectives, you can make certain that you are on track to satisfy your economic demands and avoid unnecessary anxiety.

To start, it is crucial to estimate exactly how much you will certainly require to save for university. Take into consideration factors such as tuition fees, textbooks, lodging, and various other assorted expenditures. Looking into the ordinary costs of colleges and universities can supply you with a standard for establishing your conserving objectives.

As soon as you have a clear concept of the quantity you require to save, break it down into smaller, manageable goals. Set month-to-month or annual targets that straighten with your current monetary situation and revenue. This will help you stay inspired and track your development with time.

In addition, take into consideration making use of devices such as university financial savings calculators or dealing with a financial advisor to get a deeper understanding of your saving possibility (Save for College). They can supply beneficial insights and guidance on how to optimize your savings method

Consider Different Investment Approaches

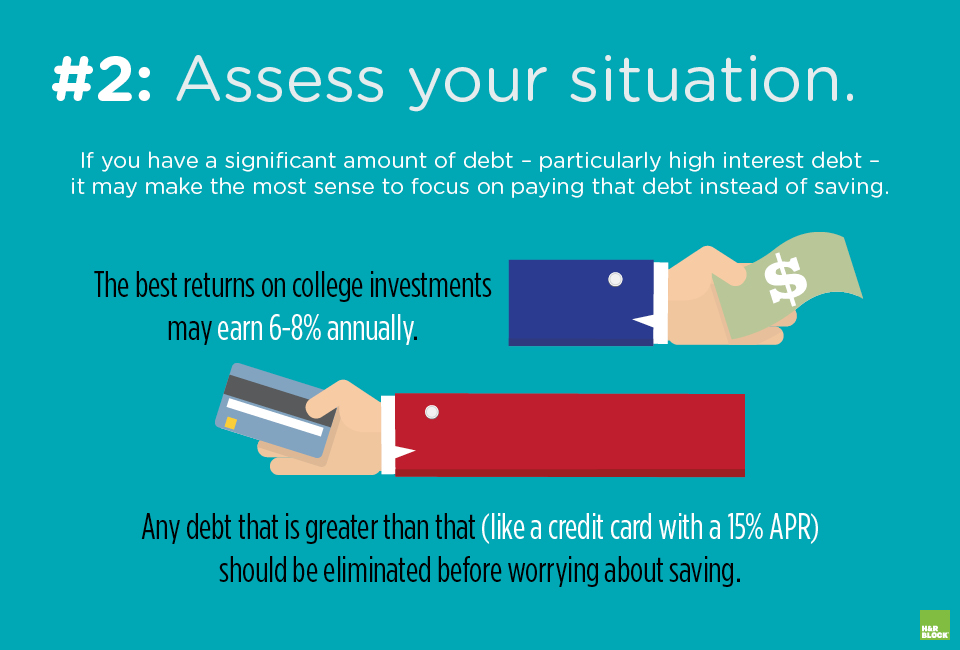

When preparing for college cost savings, it is essential to discover various investment methods to maximize the development of your funds. Purchasing the right strategies can assist you accomplish your savings objectives and provide economic safety for visit site your kid's education and learning.

One usual investment approach is to open up a 529 university cost savings strategy. This plan provides tax benefits and enables you to invest in a selection of financial investment choices such as stocks, bonds, and common funds. The incomes in a 529 plan expand tax-free, and withdrawals utilized for qualified education and learning costs are also tax-free.

Another approach to think about is investing in a Coverdell Education And Learning Cost Savings Account (ESA) Like a 529 plan, the revenues in a Coverdell ESA expand tax-free, and withdrawals are tax-free when used for certified education expenditures. Nevertheless, the payment limitation for a Coverdell ESA is reduced compared to a 529 strategy.

Make Use Of Scholarships and Grants

To better boost your university financial savings approach, it is crucial to profit from the opportunities presented by scholarships and grants. Gives and scholarships are financial assistances supplied by different organizations and organizations to help students cover their college expenditures. Unlike gives, scholarships and finances do not navigate to this website require to be paid back, making them an excellent alternative to lower the monetary concern of college.

They can be offered by universities, private companies, or federal government entities. It is necessary to research and use for scholarships that align with your rate of interests and toughness.

Grants, on the other hand, are generally need-based and are supplied to students who show financial requirement. These gives can come from federal or state federal governments, colleges, or personal companies. To be considered for grants, pupils frequently need to finish the Free Application for Federal Student Aid (FAFSA) to identify their qualification.

Making the most of gives and scholarships can significantly decrease the quantity of cash you require to save for college. It is important to begin researching and applying for these economic help well beforehand to enhance your opportunities of obtaining them. By carefully considering your options and putting in the effort to choose scholarships and gives, you can make a substantial influence on your university savings strategy.

Conclusion

In conclusion, making the most of college financial savings needs early preparation and discovering tax-advantaged cost savings options. By applying these crucial monetary preparation methods, individuals can guarantee they are well-prepared for their university education.

As the price of college proceeds to increase, it becomes significantly crucial to develop reliable monetary planning methods to maximize your university savings. In this conversation, we will discover essential financial preparation strategies that can assist you navigate the intricacies of college savings and guarantee you are well-prepared for the journey ahead.When you start saving for university early, you can also take benefit of various tax-advantaged cost savings vehicles, such as 529 strategies or Coverdell Education and learning Cost Savings Accounts.As you take into consideration the significance of beginning early in your college cost savings trip, it is crucial to check out news the numerous tax-advantaged cost savings alternatives available to maximize your financial savings potential.In final thought, making best use of college cost savings calls for early planning and checking out tax-advantaged financial savings options.

Report this page